Unternavigation

Equalization Funds

Equalization funds play a key role in implementing social policy. They are responsible for managing old age insurance, disability insurance and income compensation insurance, in addition to other schemes.

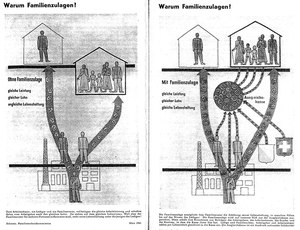

There were around a hundred equalization funds in Switzerland at the beginning of the 21st century. These funds manage old age and survivors’ insurance (AHV), disability insurance (IV), the loss of income compensation scheme for militia soldiers and child-bearing mothers (EO) as well as family allowances. The equalization funds collect contributions from employees, the self-employed and the unemployed. They are responsible for disbursing the benefits provided by these insurance programs. The equalization funds constitute legally independent institutions. The Central Compensation Office in Geneva has been monitoring them since 1948. It records the contributions collected by all equalization funds and provides them with resources to pay benefits. It also keeps a central register of policyholders and pensions. Equalization funds therefore play a leading role in implementing social policy today.

Employers from Christian-social backgrounds established the first equalization funds during the interwar period in French-speaking Switzerland. In 1938, eight such funds paid family allowances to a small range of beneficiaries (around 12,000 people) on a cooperative basis. They were modeled on similar schemes that had been developed by French and Belgian employers in the 1920s and 1930s. The equalization funds enabled the targeted disbursement of social benefits instead of wage increases and encouraged the emergence of corporate social policy independent from the state and trade unions. This drive for autonomy was also apparent in the Christian-social milieu that opposed state intervention in family policy. The combination of business initiative and Christian-social principles was also influenced by corporatist ideals (which viewed society as an organic whole and criticized liberal democracy), which were popular among the political right in French-speaking Switzerland.

Between 1938 and 1940, equalization funds were founded throughout the country alongside the development of the income compensation scheme for active militia soldiers (EO). Within just a few months, the Swiss Employers’ Federation (ZSAO) established a network of several dozen equalization funds managed by employer organisations or trade associations. Cantonal and federal funds soon followed. From the very beginning, employer organisations were in control of the management bodies of the EO and were therefore able to restrict the intervention of the state and trade unions. They controlled the flow of contributions and benefits, thereby preventing the general public from obtaining accurate statistical data regarding disbursed benefits and wages. The equalization funds also played an important role in the internal consolidation of employer organisations. Affiliation to an equalization fund wars mandatory for firms, thus facilitating cohesion and the joint action of employers.

The organizational structure of the income compensation scheme and its funding through wage contributions served as the template for the foundation for old age and survivors’ insurance (AHV). The EO equalization funds were responsible for expenses related to the introduction of AHV pensions from 1948 onwards and for disability benefits from 1960. After 1945, regional employers’ associations likewise set up a number of equalization funds for family allowances. These schemes were encouraged by cantonal legislation between 1943 and 1966. Federal standards followed in 2006.

Literatur / Bibliographie / Bibliografia / References: Eichenberger Pierre (2013), Les caisses de compensation en Suisse : du rêve corporatiste local au centralisme patronal (1929-1938), contribution présentée aux Journées suisses d’histoire, Fribourg 2013.

(12/2014)