Unternavigation

Income Compensation Scheme (EO)

The income compensation scheme (EO) for soldiers (since 1940) and in the event of maternity (since 2004) compensates for a portion of lost income during military service and after childbirth. In 1947, the EO also served as a model for the introduction of old age and survivors’ insurance.

The income compensation scheme (EO) originally arose from the social hardship faced by soldiers mobilized in the First World War, who were unable to financially support their families. In addition to major social tensions, this difficult situation contributed to the social demands expressed during the general strike of 1918. However, the issue concerning loss of income compensation during military service or retraining courses never made it onto the political agenda during the interwar period. Despite the general strike, efforts to create a national solution to this problem failed to make progress due to the unstable economic situation and business opposition against the funding of such benefits. Although large firms and the public sector gradually introduced income compensation schemes for militia soldiers, this solution only helped a small minority of servicemen affected. The costs of military service were distributed unequally among employers. This inequality constituted furthermore a disadvantage for young men looking for work, as these ones served the most time in the military.

The EO, the Mobilization of the War Economy and the AHV

In 1938, the Confederation created the structures that ensured the smooth running of the economy during wartime. Income compensation for soldiers in the event of general mobilization remerged as a topic of debate. The Federal Office for Industry, Trade and Labour (BIGA) outlined a system of state funds under the patronage of the Confederation; these funds were to disburse benefits to mobilized soldiers. Conversely, trade unions proposed to organize support for soldiers through their unemployment funds. However, neither of these projects had been implemented by the time war broke out in the summer of 1939.

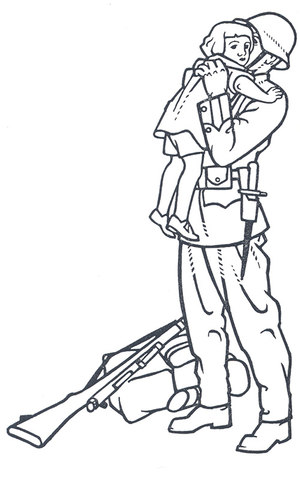

In order to prevent state intervention or union appropriation of this new social programme, the Swiss Employers’ Federation (ZSAO) took the initiative at the start of the war to found sector-based equalization funds. This scheme was immediately joined by state equalization funds set up by the Confederation and the cantons. These institutions covered the benefits for men who did not belong to an employer’s equalization fund. They not only received the wage contributions of men serving in the military, but also those from gainfully employed women and foreign nationals working in Switzerland, as well as subsidies from the Confederation. In the spring of 1940, the funds began disbursing daily allowances ranging between 80 per cent (for non-skilled workers) and 50 per cent (for employees) of wages during military service. There were supplementary benefits for fathers. The EO (which became known as 'soldiers’ protection', Wehrmannschutz) was incredibly popular. It supported families, while also consolidating the ‘corporate community’, the ‘national community’ as well as the division of roles between men and women. Soldiers' benefits also facilitated the deployment of the workforce before, during and after the periods of general and partial army mobilizations between 1939 and 1945.

During the second half of the war, the debate on the future of social security gained new momentum thanks to the success of the EO and the efficiency of its funding through wage deductions, since this system not only enabled the disbursement of benefits, but also the accumulation of large reserves. The EO ultimately provided a template for old age and survivors’ insurance (AHV). After the war ended in 1945, the equalization funds and the EO contributions served as the basis for introducing the AHV. New taxes could be avoided thanks to the transfer of some EO reserves to the new AHV Central Compensation Fund. From a symbolic perspective, this extended the solidarity established between the population and militia soldiers to the elderly. The patriarchal structure of the EO was also reflected in the AHV pensions disbursed to married couples: these were paid out to the men.

From Cold War Soldiers' Benefits to Maternity Insurance

Between 1947 and 1950, the EO received transitional funding from the reserves accumulated during the war, but the sustainability of the programme remained uncertain. In 1952, during the Korean War, the EO obtained a new constitutional basis and in 1958, funding was settled definitively with the introduction of specific wage contributions (0.4 percent of the wage and 0.6 percent since 1975). The EO represented the social side of the national defense policy enacted by the Confederation until the end of the Cold War; it guaranteed essential social benefits to ensure the operation of the militia army. The size of the Swiss army decreased at the end of the Cold War from more than 800,000 (at the end of the 1980s) to fewer than 200,000 soldiers (in 2004), and EO contribution rates were lowered accordingly.

This fundamental restructuring gave rise to the idea of expanding the EO to maternity. This proposal was first presented in 1984 after the failure of the maternity insurance initiative and was ultimately implemented in 2004. The adoption of this loss of income compensation for maternity has led to a better spread of the burden of risk, as employers no longer have to pay the wages of women after childbirth themselves. In 2012, the EO disbursed benefits to people in military service (145,000 beneficiaries), civic or civil defense service (70,000), as well as to army recruiters or sports coaches (45,000) and around 68,000 mothers. Maternity benefits cover 80 per cent of the wage during 14 weeks of maternity leave (no more than 196 francs/day) and account for around half of EO expenditures (i.e. 713 million francs out of a total of 1.52 billion francs in 2012). Having paid EO contributions for over 60 years and subsidized the benefits for the male population, women are now entitled to a loss of income compensation provided they have paid in at least nine months of AHV contributions and have been employed for at least five months. Unemployed women continue to be excluded from these benefits.

In the case of the EO, an interesting thread runs through the historic development of social security in Switzerland, from national defense to maternity protection.

Literatur / Bibliographie / Bibliografia / References: Leimgruber Matthieu (2010), Protecting soldiers, not mothers: soldiers’ income compensation in Switzerland during World War II, Social Politics, 17: 1, 53–79; Leimgruber Matthieu (2009), Schutz für Soldaten, nicht für Mütter. Lohnausfallentschädigung für Dienstleitende und Sozialversicherungen in der Schweiz, in M. Leimgruber, M. Lengwiler (Hg.), Umbruch an der ‚inneren Front‘. Krieg und Sozialpolitik in der Schweiz 1938–1948, 75–99, Zürich.; Stämpfli Regula (2002), Von der Grenzbesetzung zum Aktivdienst. Geschlechterpolitische Lösungsmuster in der schweizerischen Sozialpolitik (1914–1945), in H. J. Gilomen, S. Guex, B. Studer, Von der Barmherzigkeit zur Sozialversicherung, Zürich.

(12/2015)