Unternavigation

Financing and Calculation Models in Old Age and Survivors’ Insurance (AHV)

Mathematics and statistics have been important tools in the history of old age and survivors’ insurance, notably in terms of planning its development and financing. In the 1920s and 1930s, prior to the introduction of the AHV, the Confederation published a number of different forecasts. Calculations on the amount and adjustment of AHV pensions as well as the distribution of contribution obligations followed after 1948.

Planning for the AHV in the 1920s and 1930s

The introduction of the AHV was already planned in the 1920s; however, it was delayed due in part to disagreement regarding how it should be financed. The law project drafted by Federal Councilor Edmund Schulthess failed in a 1931 referendum vote not least because of its contested financing model. Three issues were central in the debates leading up to the referendum. The first question referred to whether the AHV was to be financed through a funded scheme or a contribution-based (or pay-as-you-go) system. In the case of the former, individual policyholders contributions would be invested and paid out as a pension once the policyholder reached a certain age, as is currently the case in occupational old age provision. Whereas with the latter system, old age pensions would be paid out from insurance contributions levied on an ongoing basis such that the working, contributing generation would finance pension recipients. In 1919, a preliminary study on AHV financing prepared by actuarial mathematician and SUVA employee Paul Nabholz recommended the funded scheme option as it ‘undoubtedly corresponded most closely with the sensibilities of contributing policyholders’. Although the Schulthess project ultimately opted for the current pay-as-you-go system, it was secured by a significant AHV reserve fund financed primarily by the state. Secondly, while planning for the AHV it was important to foresee demographic developments and in particular the arithmetic relationship between contributors and recipients. In 1928, the Federal Social Insurance Office therefore commissioned mathematician Werner Friedli, professor for actuarial mathematics and technical director of the pension fund for federal civil servants, to calculate the demographic statistical foundations of the AHV. Friedli was familiar with the latest available demographic research and was aware that Switzerland was undergoing the demographic change associated with an aging society. He calculated a steady reduction in population growth for the period from 1920 to 2000. At the turn of the millennium, growth would hit zero – an equilibrium between the number of deaths and emigration on one side and births and immigration on the other. In the case of the AHV, this predicted slowdown of population growth meant that the relationship between contributors and recipients would be in danger of deteriorating, which had to be taken into consideration in the planned financing. In retrospect, his forecasts proved too pessimistic. Contrary to his prediction, there was no collapse in population growth; instead it increased continuously in the second half of the 20th century. It amounted to around half a per cent in 2000 and surpassed the one per cent mark in 2007. The third important matter concerned financing sources for the AHV. The moderate benefits envisioned by the first Schulthess project combined a basic pension to which all policyholders were entitled, as well as additional means-tested allowances. The basic pension was to be financed by employer and employee contributions while 80 per cent of means-tested supplements had to be funded by the Confederation and 20 per cent by the cantons. The Confederation would be allowed to use tobacco and alcohol duties for this purpose. There was also talk of introducing an inheritance and gift tax as well as a one-off capital levy to finance the AHV, but these measures were not implemented. These financing proposals in particular made the AHV bill unpopular and played a substantial part in the no vote of 1931.

Drafting the AHV

The AHV bill of 1947 successfully passed the referendum hurdle, in part because the Income Substitution Insurance for Militia Soldiers (EO) provided a new baseline for financing. The introduction of the EO meant that a contribution-based social insurance system already existed, though it was downsized after the end of the war. The EO model was then adopted by the AHV. The additional financial burden for employees and employers was therefore relatively small as the new AHV contributions were partially funded through reduced EO contributions. In contrast, the financial subsidies paid by the state were more controversial. In part, these expenditures were covered by the revenues from alcohol and tobacco taxes partially earmarked for this purpose. The introduction of an additional wine tax was rejected due to opposition from the farmers’ association. A federal inheritance tax was also considered but discarded after opposition from the cantons which themselves laid claim to wealth taxes. In addition, Parliament decided against using a portion of the turnover tax for the AHV. The introduction of a new tax was ultimately avoided – due to recalculations by the federal administration, which resulted in a reduced burden for the state, and thanks in particular to the use of EO reserves to jumpstart the AHV. This financing model did not change fundamentally until the end of the 20th century. The first eight AHV revisions increased payroll contributions to AHV from 4 to 8.4 percent. When state subsidies were temporarily frozen in 1975 due to financial strains in the federal budget, the question was raised as to whether other sources of financing could be used for the AHV.

The Ninth AHV Revision

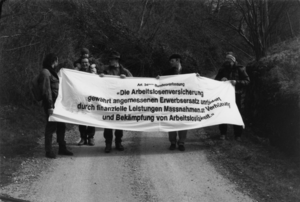

Another fundamental debate on financing took place in 1978 I the course of the ninth AHV reform. This was the first AHV revision to be contested by a referendum (direct democracy). Other than the previous revisions, the ninth revision no longer included any clear expansions to benefits. It represented the transition from social welfare expansion to a policy of consolidation. The most controversial aspect was the amount of federal contributions, which still amounted to 15 per cent at the end of 1974 (1310 million francs in absolute figures) and were to be increased to 18.75 percent in 1978. Instead, federal contributions were subject to a temporary reduction to nine per cent when the Confederation introduced emergency measures in 1975 in order to balance its budget. The sentiment among politicians during the negotiations of the ninth AHV revision changed so profoundly that a further increase to federal contributions no longer enjoyed majority backing. Instead, they were only to be increased gradually back to 15 per cent from 1978 to 1982 – the level prior to the oil crisis. There was also the question as to how the federal contributions to AHV would be funded as returns from tobacco and alcohol duties were no longer sufficient. The Federal Council proposed to convert the turnover tax into a value added tax. However, back then, this proposal faced insurmountable political obstacles. Alongside the ninth AHV revision, the government also decided on the indexing of pensions. Pension benefits had been raised a number of times since the introduction of the AHV in 1947. The last increases were carried out as part of the eighth AHV revision. Pensions were thereby increased in two steps: by 80 percent in 1973 and by 25 per cent two years later. In connection with the ninth AHV revision, the Federal Council proposed the automatic indexing of AHV pensions towards the end of 1973; such indexing would not only take inflation into account, but also wage trends. As a result of the 1974/1975 recession, both chambers of the Federal Assembly ultimately only accepted partial indexing; pensions were henceforth adjusted according to a new index representing the mean between inflation and general wage development (introduction of indexed AHV pensions).

AHV Finances in Recent Times

Debates about AHV finances have continued more recently. Whereas an increase to employee and employer contributions was not up for discussion, new taxes have been created to fund the AHV. Since 1999, the AHV has been additionally financed by a percentage of the new value added tax. The so-called ‘demographic percent’ represents the first instance of tax funding directly earmarked for the AHV. A year later, another source of AHV funding was added with casino duties. In 2013, the federal contribution to the AHV amounted to 20 per cent; the remaining 80 per cent was provided by payroll contributions.

Literatur / Bibliographie / Bibliografia / References: Sommer Jürg (1978), Das Ringen um die soziale Sicherheit in der Schweiz. Eine politisch-ökonomische Analyse der Ursprünge, Entwicklungen und Perspektiven sozialer Sicherung im Widerstreit zwischen Gruppeninteressen und volkswirtschaftlicher Tragbarkeit, Diessenhofen ; Ischer Philipp (2006), Ausbau oder Konsolidierung? Der politische Diskurs der 1970er Jahre in der Schweiz im Bereich der AHV, Studien und Quellen, 31, 141–166 ; Lengwiler Martin (2007), Vom Übervölkerungs- zum Überalterungsparadigma. Das Verhältnis zwischen Demographie und Bevölkerungspolitik in historischer Perspektive, in E.Barlösius, D. Schiek (ed.), Demographisierung des Gesellschaftlichen. Analysen und Debatten zur demographischen Zukunft Deutschlands, Wiesbaden, 187-204.

(12/2015)